Exploring China’s City Tiers

This article is part of our series on The Middle Kingdom. You can view the full series or download the report.

Welcome to the Middle Kindom

The Chinese name of China is 中国 (pronounced ‘zhong guo’) which translates literally to ‘Middle Kingdom’. This dates back to ~1000BC when the Chinese were in relative isolation from the rest of the world, separated by the Himalayan mountains in the southwest, the Gobi Desert to the north and the Pacific Ocean to the east. As such, Chinese people assumed they were at the centre of the world, and aptly named their country the ‘Middle Kingdom.’ Our goal in this blog is to provide everyone with bite-sized insights into China’s Culture, Customs, and Consumers.

Exploring China’s different city tiers

China is a vast country covering an area of approximately 9.6 million sq km and harbouring a population of 1.402 billion people (2021). Given this immense scale and the diversity within it, it is impossible to approach the country as a single unified market. The city-tier classification is one tool that businesses, analysts and even Chinese people themselves use to navigate the 613 cities that exist in China.

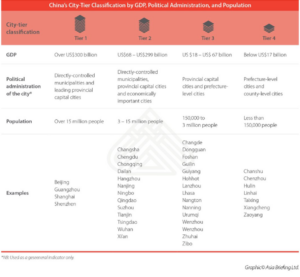

It’s worth noting that the tier system is not officially recognised by the Chinese government (unlike city clusters), therefore there are no official criteria that determine which city fits into which tier. However, the consensus is that the classification of a city into four different tiers is based on three factors: GDP, population & political administration.

See below for a breakdown of the different tiers:

If we were to classify some British cities by the tier system, (in our humble opinion) it might look like this:

- Tier 1 – London

- Tier 2 – Birmingham, Manchester, Glasgow

- Tier 3 – Bristol, Oxford, Cambridge, Durham

- Tier 4 – Luton, Grimsby, Whitby

When it comes to research and innovation in the China market, the focus is often placed on Tier 1 cities (Beijing, Shanghai & Guangzhou in particular) where disposable income is higher and consumers have more access to international brands. However, over 70% of the population live in Tier 3 and lower cities and spending power is increasing in these areas with unique consumer behaviours developing. While disposable income may be lower, they have a lower cost of living with more leisure time as work pressure is much less than in Tier 1 & 2 cities.

Chinese e-commerce app Pinduoduo has exploded in lower-tier cities, connecting brands with this new audience previously that has previously been disregarded. The attraction lies in the group-buying function, which allows users to invite friends or connect with strangers to make group purchases of daily items and incredibly low prices. This offering is particularly popular with middle-aged women in lower-tiered cities who are more price-conscious and value a good price-quality ratio while shopping for their families. The group buying model leverages ingrained sharing culture in China, and Pinduoduo’s specific targeting of a more niche audience as well as its foray into the direct-to-consumer agricultural business has allowed it to grow into the third-largest e-commerce platform in China (5th in the World), only after Alibaba and JD.com.

So What? The city-tier system is a quick and easy tool that is often used to compare and contrast consumer segments across a huge number of cities in China. However, do note that analysing this way does have its limitations and should rarely be used in isolation. Each city has its own local culture, infrastructure and trends which fall outside of what the city tier classification system can measure. While higher-tier cities are traditionally chosen as the focus for international brand development in China, turning your attention to lower cities may provide more opportunities with less competition.