Decoding the DNA of Pepsi Prebiotic Cola

This article is part of our series on DNA of Campaigns. You can view the full series or download the report.

Alert: commotion in the beverage aisle! Something’s brewing in the functional beverage category…

PepsiCo has announced the launch of Pepsi Prebiotic Cola in early 2026. This follows its big acquisition of Poppi, a prebiotic soda brand, for US$1.95 bn in March 2025. The compound annual growth rate for this category has jumped from 5% in 2015-2020 to 8% between 2021-2025. The market, currently valued at US$150 billion, is projected to reach US$250 billion by 2030.

So, what’s driving this surge? As people become increasingly health-conscious, they are making smarter choices about what they drink. They’re shifting away from classics like Pepsi Cola and gravitating toward beverages that do more for the body – whether that’s RTD protein drinks, CBD beverages, or options that support digestive health.

In this instalment of our Decoding the DNA of… series, Associate Director Peter Sainthouse explores why PepsiCo’s bold leap into prebiotic beverages is such a landmark moment in the market… And why it makes perfect sense.

A giant joins the prebiotic drinks category

PepsiCo’s dive into prebiotic beverages is its first major cola innovation in 20 years, so a big change on the cola shelf. But it’s more than just a milestone; it comes at a moment when younger consumers are seeking healthier choices without compromising their lifestyle. How? They’ll get the best of both worlds: the classic Pepsi taste, paired with added gut health benefits. This prebiotic (not probiotic) cola is designed to support the good bacteria already in your body, with just 30 calories, 5g of sugar, and no artificial sweeteners. With its major investment in functional soda brand Poppi, PepsiCo has made a decisive pivot towards wellness, positioning this new cola as a ‘healthy pleasure’ rather than a taste-driven refreshment hit.

With a beverage giant like Pepsi entering the scene, this could be the breakthrough prebiotic sodas have been waiting for. Until now, the category has struggled to turn awareness into regular purchase, hampered by an education gap (wait, what’s prebiotic?) and consumer wariness around ‘healthy drinks’. The segment certainly has an image problem – but with PepsiCo’s marketing expertise, beverage experience, and flavour know-how, we feel that’s about to change.

More than just a ‘healthy drink’

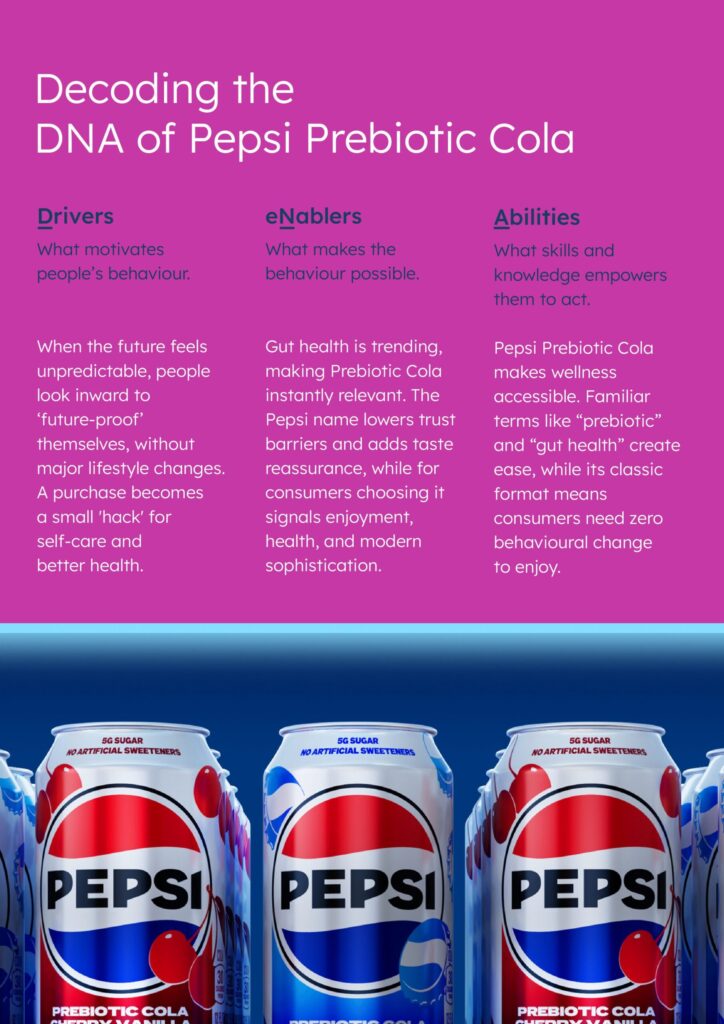

In true Brand Genetics fashion, we’re decoding the DNA behind Pepsi’s calculated move into functional beverages to uncover what truly drives behaviour, and why this move fits perfectly into today’s cultural landscape.

People are constantly bombarded with news, geopolitical shifts, societal pressures, and economic uncertainty – creating a steady hum of anxiety in daily life. This is a key Driver of behaviour. When the future feels unpredictable, people look inward to ‘future-proof’ themselves in small, manageable ways, without major lifestyle changes. A simple purchase becomes an act of self-care – a small ‘hack’ for better health, even when indulging. The Pepsi Prebiotic Cola will allow consumers to feel proactive and empowered, boosting their self-esteem and strengthening their emotional connection to the brand through a positive experience. In a world of uncertainty, it’s confidence in a can.

But Drivers are nothing without the right eNablers. The cultural and market context will allow this launch to resonate. Culturally, the timing couldn’t be better. Conversations about gut health, biomes, and prebiotics are everywhere, which will make the product feel immediately relevant. And while they are entering as a new functional soda, the Pepsi name carries a reassurance for the taste, not a niche brand tucked away in a health shop. That recognition will instantly reduce the ‘trust barrier’ that often deters people from trying the new health drink. On an individual level, choosing the drink will signal, “I’m someone who enjoys life, but I’m also informed and health-conscious.” It’ll become a subtle form of social validation – a badge of modern sophistication. For Pepsi, that’s a kind of social currency money can’t buy.

The final piece of the puzzle lies in the Abilities that make it easy for consumers to act on their motivation. Accessibility is key: physical, mental, and behavioural. Pepsi Prebiotic Cola will bring wellness out of the boutique and into the mainstream, making it available to a wider audience and no longer restricted to those who can afford it. Meanwhile, terms like “prebiotic” and “gut health” are now familiar enough that, even without scientific understanding, people intuitively know they’re “good for your tummy.” This creates mental ease – it’s simple and intuitive. Above all, it’s behaviourally accessible: the drink will need zero behavioural change – it’ll fit seamlessly into existing habits and rituals. By integrating effortlessly into everyday life, Pepsi Prebiotic Cola will become a healthier choice people can keep coming back to.

Key Takeaways for Brands

PepsiCo’s move shows how strategic timing, staying culturally in tune, and consumer insights can turn a simple product update into a potentially market-shifting launch. There’s a lot that brands can learn from this moment – whether it’s about front-end innovation, new product development, smart positioning for new and existing products like the classic cola.

- Reframe, don’t replace: The strength of Pepsi Prebiotic Cola is that it isn’t a ‘health drink’ – it’s a cola with added functional benefits that doesn’t compromise the core Pepsi taste. Brands can look for opportunities to re-imagine existing product options rather than asking consumers to give something up.

- Stay in tune with culture: Part of PepsiCo’s advantage lies in aligning with the cultural conversation around gut health. Identifying relevant trends helps make products feel modern, relevant, and socially smart – providing a powerful tailwind for adoption.

- Make it easy: The drink requires zero behavioural change, as all the best innovations do. Don’t ask your customers to reinvent their routine; minimise the friction to make adoption effortless.

With all the behavioural factors aligning, we, for one, think this is the launch to watch out for in 2026.