How Brands Grow Part 2 (2016) [Speed Summary]

How Brands Grow: Part 2

How Brands Grow: Part 2- Author: Byron Sharp & Jenni Romaniuk

- Publisher: Oxford University Press

- Publication: 2016

Are you a card-carrying ‘Sharpie’? (fan of Prof. Byron Sharp and the simple Ehrenberg-Bass approach to growing brands). If so, then you’re in for a treat with How Brands Grow Part 2 (HBG2), the followup to the original must-read international bestseller on brand building.

Part 1 was made famous for its authoritative, evidence-based and scathing attack on how brands are so often mismanaged using brand voodoo made up of bad ideas and bad practices (with a particularly vicious take-down of the vacuous anthropomorphisation of brands with evidence-free claims that people ‘love’ brands, are ‘loyal’ to a brand or want to have ‘relationships’ with brands).

In Part 2 of HBG, the style settles down somewhat and Sharp and colleague Prof. Jenni Romanuik offer some rather useful evidence-based advice for how, practically speaking, to grow your brand, drawing from a range of sectors including e-commerce, luxury, services, B2B and emerging markets. The book is long, dense and stat-packed, but the central insights can be summarised into 5 key points.

1. Grow your brand by getting more customers. This sounds self-evident, but much marketing is focused on driving brand loyalty and retention. Loyalty is largely a function of habit – and customers are loyal to repertoires not brands. So get over it. Moreover, the Law of Double Jeopardy (that small brands have fewer buyers and who buy less frequently) applies across categories and markets and means that the less penetration you have among category buyers, the lower their purchase frequency of your brand. Get more customers, and behavioural loyalty comes as a consequence. It follows that getting more customers (customer acquisition) should be the primary goal your brand strategy. Now you know.

2. Grow your brand by targeting (light) category buyers. Forget micro-targeting, profiling, segmentation, or other whizz-bang targeting, the undervalued light category user is your best bet for winning the penetration game. Why? Because most customers are light category buyers, so you have more chance of recruiting them. Find out how to appeal to the typical light category buyer, and appeal to them. Simple, really. More generally, target the whole market of category buyers, rather than an invented segment that exists only in a dodgy segmentation analysis or algorithm. In other words, keep it simple. And burn that segmentation analysis and targeting algorithm.

3. Grow your brand by being available. The core function of branding is to maximise physical and mental availability, that is, to ensure that your brand is a) easy for people to buy, and b) famous so they remember to choose you. Do this, and you will win more category buyers, and you will grow.

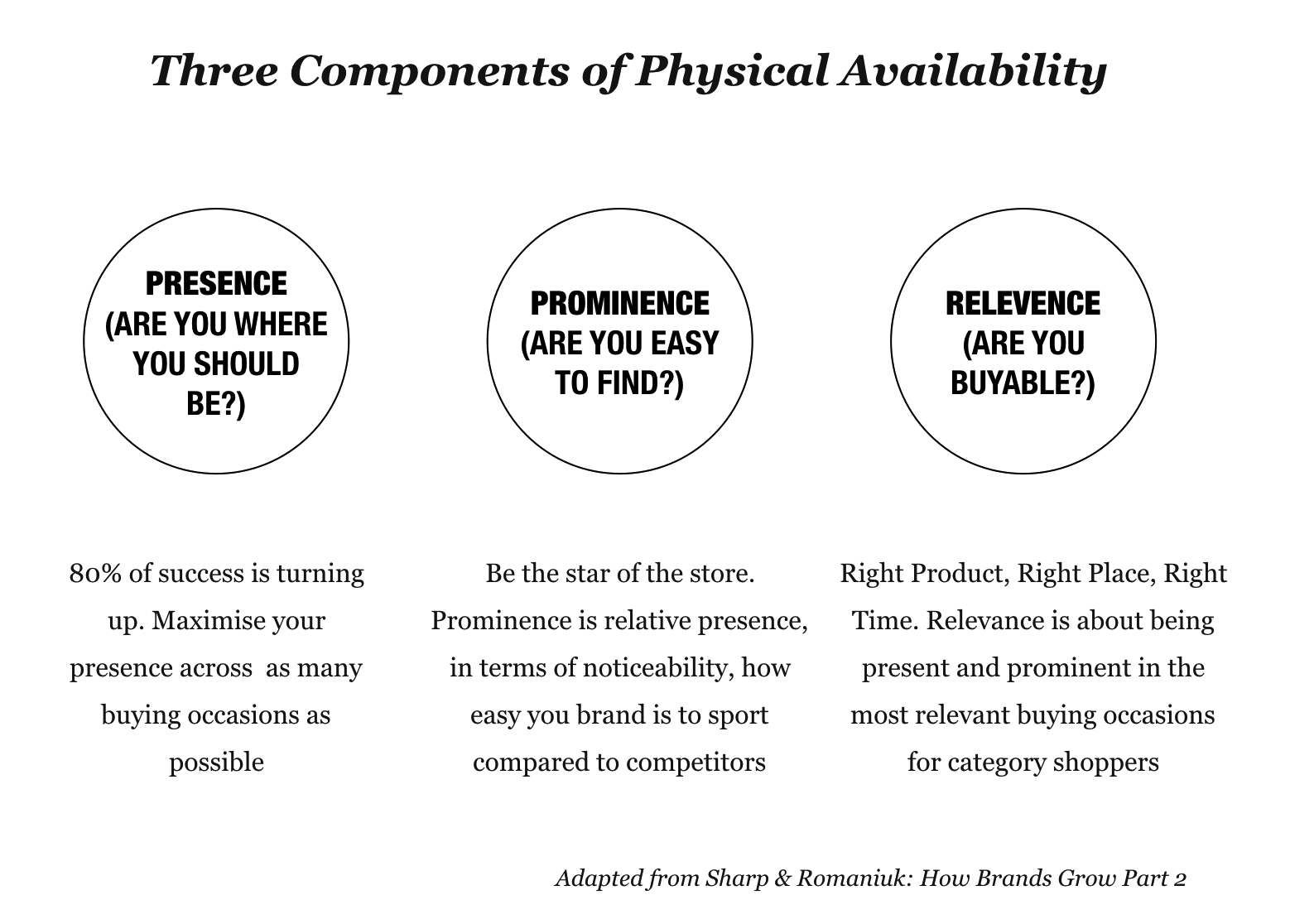

- Physical availability refers to how easy it is for category buyers to find and buy your brand, and this availability is a product of Presence, Prominence and Relevance. Presence refers to being in present for category buyers in a broad range of buying situations. It’s the Woody Allen insight that 80 percent of success is simply showing up. Prominence is a relative presence, in terms of noticeability, compared to your competitors. It’s about being out on display. And Relevance is about context, about being present and prominent in category buying situations.

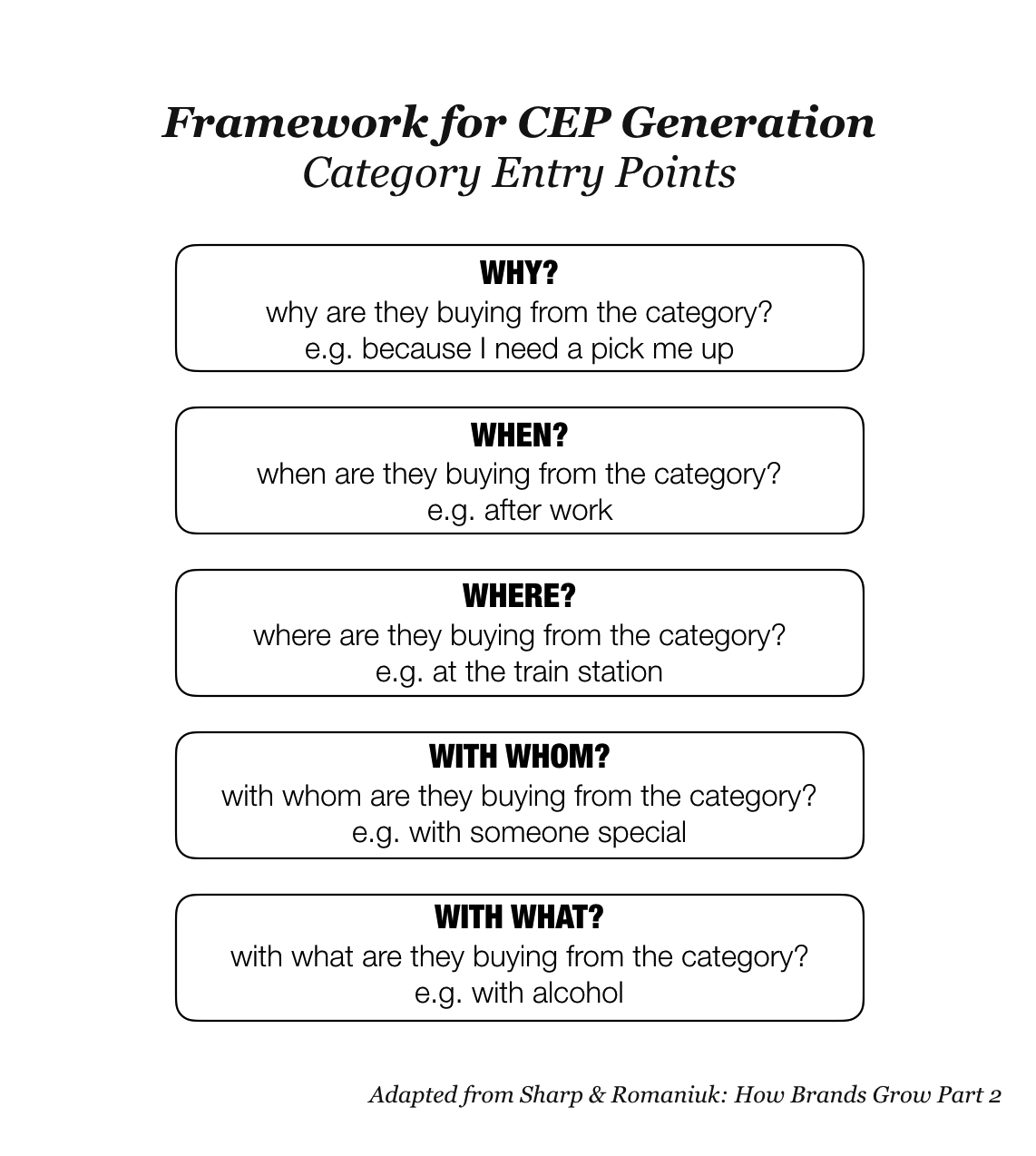

- Mental availability is the propensity for the brand to be thought of in buying situations (aka “cued-retrieval“). For this to happen, category buyers must first be exposed to your brand in a way that encodes your brand to be into memory such that a buying situation will cue retrieval. For this you need to make your brand famous and distinctive, and build associations between your brand with the reasons and occasions for category purchase. A simple way to do this is to create associations with ’category entry points’ CEPs – the why, when, where, ‘with whom’ and ‘with what’ of category purchase (see chart below). Your other weapon is brand assets…

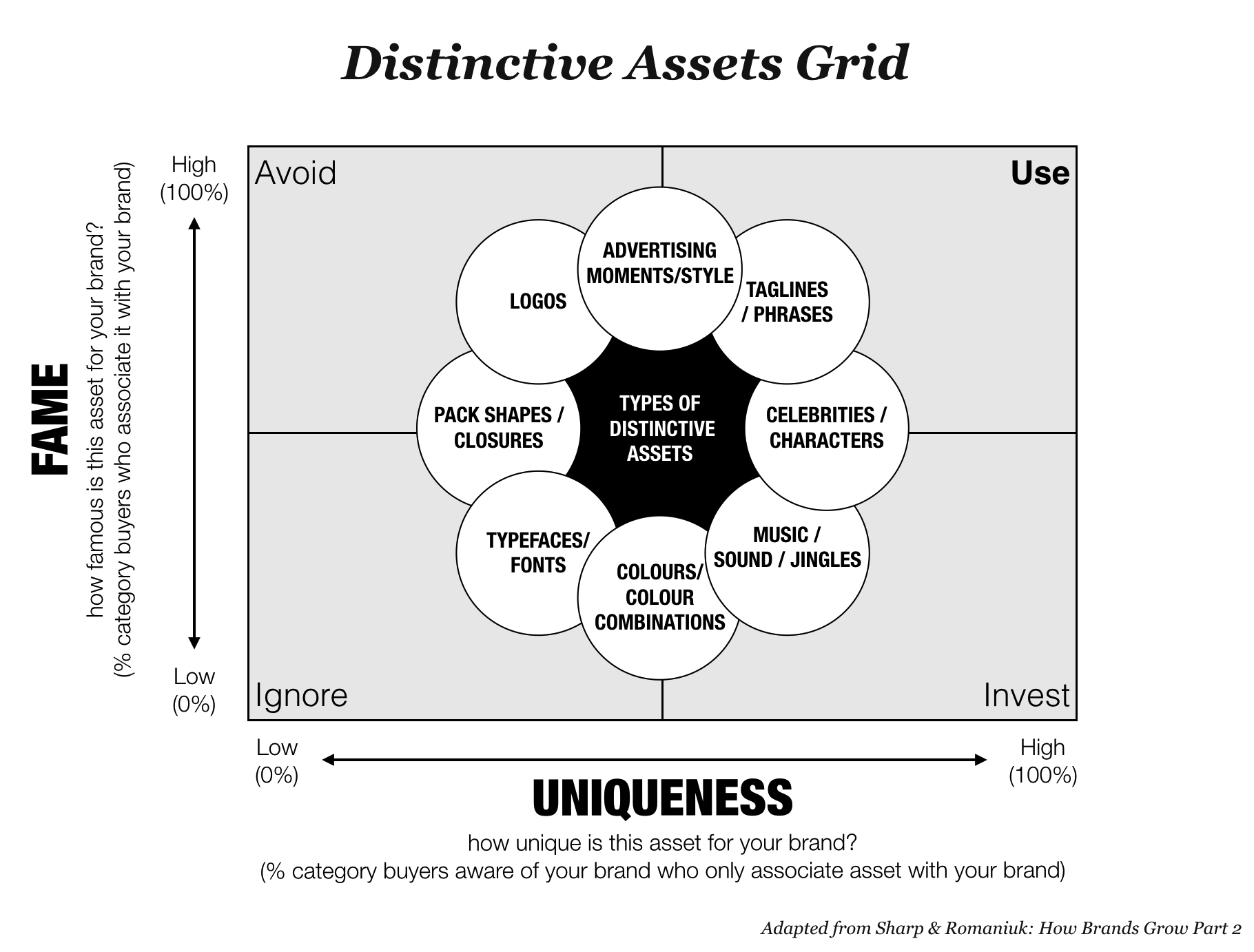

4. Grow your brand with distinctive brand assets. Distinctive brand assets are non-brand name elements such as celebrities, characters, colours, shapes, and sounds that people associate with your brand. The more category buyers who link your brand to these assets, and not other brands, the more distinctive your brand is – and the more likely it is to stand out in the minds of category buyers. This is where branding gets creative; create assets that people associate with positive memories, achievements, or aspirations.

5. Grow your brand by doing smart brand research. Most brand research is nonsense, using leading questions, dubious segmentations based on dodgy cluster analysis, or voodoo vanity metrics and measures. They are not helpful for informing brand strategy, or optimising branding’s contribution to growth. Instead focus brand research on these core brand measures

- Mental Market Share: Your brand’s % of CEP associations of total CEP associations for the category

- Mental Penetration: % of category buyers that link your brand to at least one CEP

- Network Size: How many CEPs your brand is linked to in the minds of category buyers who are aware of your brand

- Brand Distinctiveness: Test brand assets to see how famous and unique they are. Fame is the % of buyers who associate a specific element (e.g. colour) to your brand. Unique is the % of category buyers who only associate that asset with your brand (see Distinctive Assets Grid below)

The Brand Genetics Take

Of course, branding and media professionals have a vested interested in rejecting How Brands Grow (Parts 1 and 2), because it shows brand management to be a relatively simple, and straightforward task – build mental and physical availability, and target the whole market, with a particular focus on light category buyers. There’s little room for money-spinning brand onions, keyholes, or pyramids, nor for expensive targeting algorithms or customer segmentation. But whether or not you buy into the whole Ehrenburg-Bass enchilada proposed by Sharp, HBG2 provides useful insights not only for brand building, but also for brand innovation. We particularly like the unpacking of mental availability into CEPs – category entry point associations, which could be used to identify space for new brands (CEPs that are not associated with brands). We also like the insight that category understanding (rather than brand understanding) is the source of insight. The idea that brand assets and not brand concepts are key to success is also valuable. And the core idea that success for new brands lies in addressing the needs of typical light category buyer, rather than focusing esoteric niches or segments is invaluable. The dense detail-oriented nature of HBG2 means it is unlikely to be as widely read at its bombastic precursor, but that just makes HBG2 all the more valuable for innovators and marketers tasked with creating and growing a brand.